montgomery county al sales tax return

Penalty - Late Filing Fee. Penalty - Late Filing Fee.

Thank you for visiting the Montgomery County AL.

. Minimum of 50 or 10 of tax due. Taxpayer Bill of Rights. The December 2020 total local sales tax rate was also 10000.

The Montgomery sales tax rate is. The current total local sales tax rate in Montgomery AL is 10000. The State of Alabama administers over 200 different city and county sales taxes.

My Alabama Taxes MAT is the states electronic filing and remittance system used for the filing of state city and county sales use rental and lodgings taxes. The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales taxesThe local sales tax consists of a 250. The Alabama sales tax rate is currently.

The Montgomery County AL is not responsible for the content of external sites. This includes the rates on the state county city and special levels. The minimum combined 2022 sales tax rate for Montgomery County Alabama is 763.

Min of 50 or 10 of tax due Any. The Alabama state sales tax rate is currently 4. This is the total of state county and city sales tax rates.

RETURN DUE Monthly filers should file each calendar month on or before the 20th of the following month even if no tax is due. There is no applicable special tax. Total Tax Due Total of Column E All returns with zero tax payment should be filed with MyAlabamaTaxesalabamagov 2.

Sellers UseSales Tax Consumers Use Tax MAIL RETURN WITH REMITTANCE TO. You will be redirected to the destination page below in 5. Click any locality for a full.

This is the total of state and county sales tax rates. The average cumulative sales tax rate in Montgomery County Alabama is 965 with a range that spans from 65 to 10. The 10 sales tax rate in Montgomery consists of 4 Alabama state sales tax 25 Montgomery County sales tax and 35 Montgomery tax.

2022 Alabama Sales Tax By County. Spear Montgomery County Revenue Commissioner PO. This includes the rates on the state county city and special levels.

Alabama has 765 cities counties and special districts that collect a local sales tax in addition to the Alabama state sales tax. The sales tax rate in Montgomery Alabama is 10. Total Tax Due Total of Column E All returns with aero tax payment should be filed with MyAlabamaTaxesalabamagov 2.

This is the total of. SalesSellers UseConsumers Use Tax Form. For a more detailed breakdown of rates please refer to our table below.

Motor FuelGasolineOther Fuel Tax Form. In addition to the State Sales Tax local sales taxes are also due and these rates vary. The current total local sales tax rate in Montgomery County AL is 6500.

You can print a. Act 2012-279 required the Alabama Department of Revenue to develop and make available to taxpayers an electronic single-point of filing for state county andor municipal sales use and. Please note that your payment will be made directly to Montgomery Countys bank and NOT the ADORs bank please contact Montgomery County at 334 832-1697 or via e-mail for the.

Box 4779 - Montgomery AL 36103. The minimum combined 2022 sales tax rate for Montgomery Alabama is.

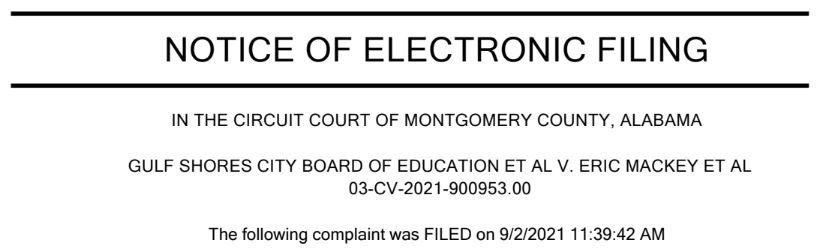

Gulf Shores Sues Baldwin County Over Sales Tax For Schools

Emergency Rental Assistance Montgomery County Eramco Montgomery County Al

Pennsylvania Sales Tax Guide For Businesses

Form 40 Fillable 2014 Alabama Individual Income Tax Return Includes Form 4952a Schedules A B Cr D E And Oc

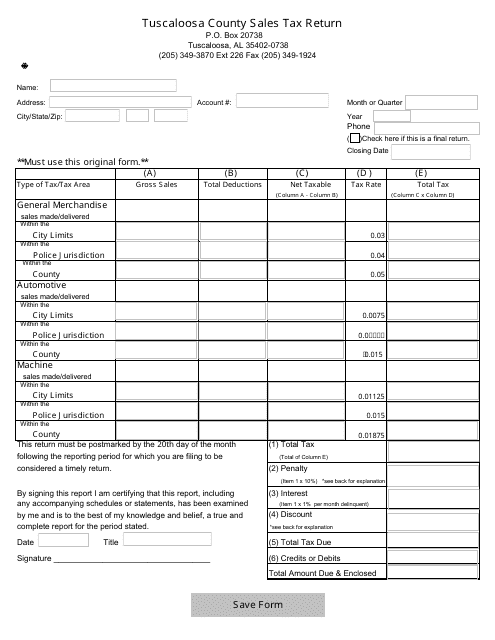

Special Sales Tax Board Tuscaloosa County Alabama

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

How Much Is Montgomery Alabama Sales Tax Ozark

Local Income Taxes In 2019 Local Income Tax City County Level

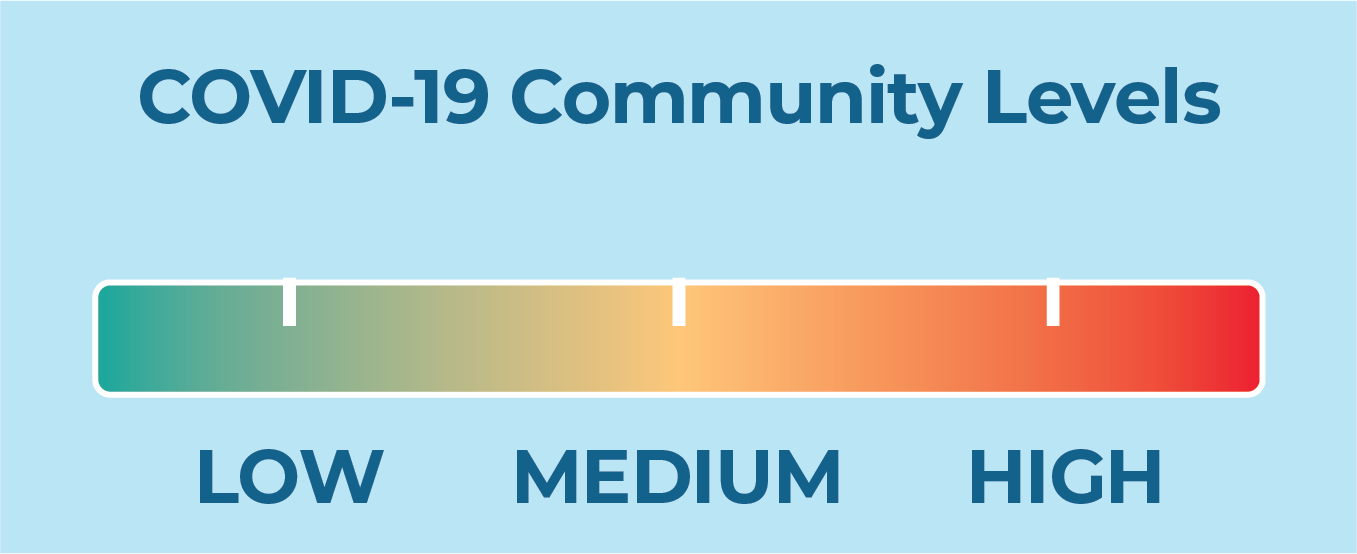

Covid 19 Information Portal Montgomery County Maryland

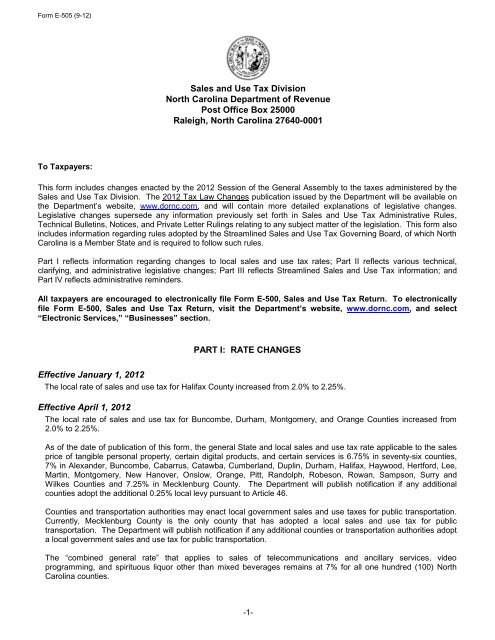

2012 Form E 505 Nc Department Of Revenue

Montgomery County Md Property Tax Calculator Smartasset

Form St Ex A2 Fillable Application For Sales And Use Tax Certificate Of Exemption For An Industrial Or Research Enterprise Project

Short Staffed Montgomery Sheriff And Jail Face More Coronavirus Cuts

Montgomery Business Personal Property Tax Return Due Jan 18 Al Com

Form 40 Fillable 2014 Alabama Individual Income Tax Return Includes Form 4952a Schedules A B Cr D E And Oc

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

Alabama Sales Tax Guide For Businesses

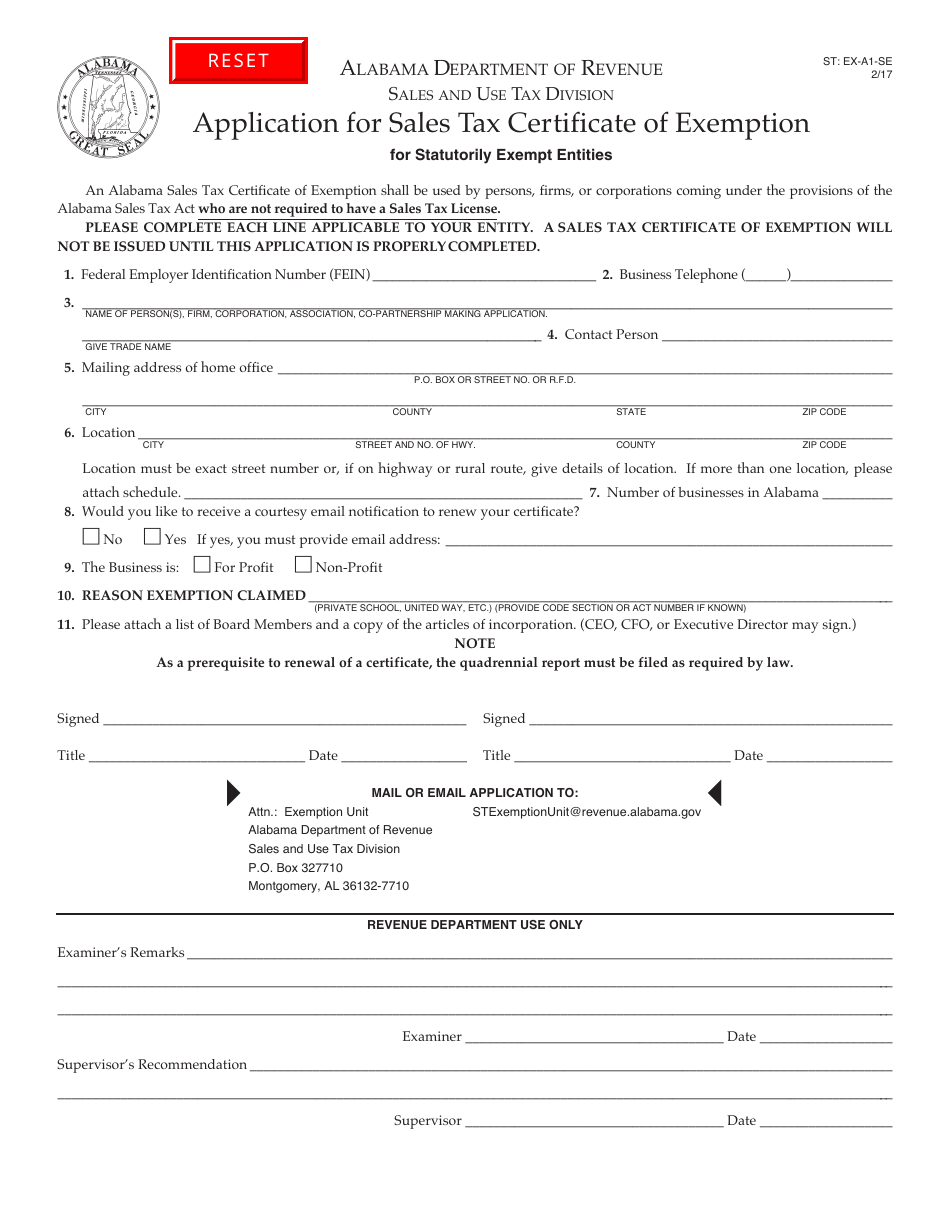

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller